Corporate strategy: what is it?

By analyzing all the company’s businesses to determine how to create the most value, Corporate Strategy takes a portfolio approach to strategic decision making. It is important for firms to consider the following factors when developing a corporate strategy:

- The relationship between their various businesses

- Interactions between them

- Governance, processes, and human capital of the parent company.

Business strategy is concerned with an individual company’s strategic decisions, while corporate strategy builds on top of that.

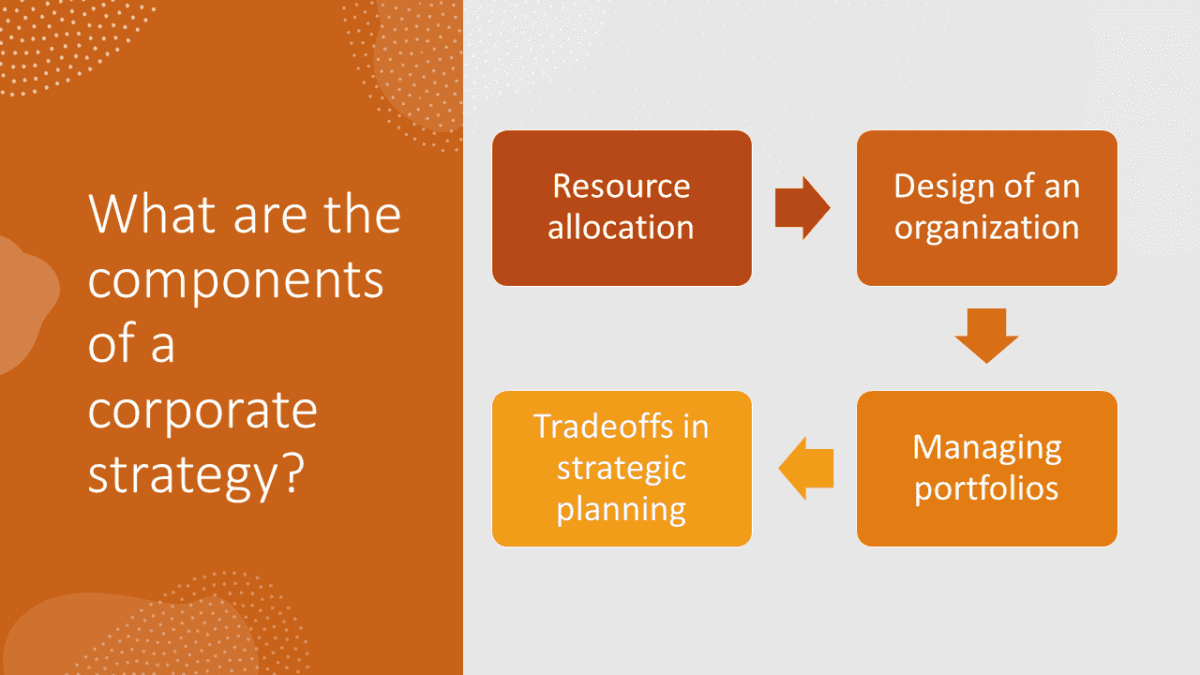

What are the components of a corporate strategy?

Leaders pay attention to several important components of a company’s corporate strategy. Corporate strategy consists of the following tasks:

- Resource allocation

- Design of an organization

- Managing portfolios

- Tradeoffs in strategic planning

These four main components will be divided into sections in this guide.

1. Resource allocation

At a firm, people and capital dominate the allocation of resources. To maximize the value of the entire organization, leaders must determine how to allocate these resources effectively among different businesses or business units.

Resources are allocated based on the following factors:

People

- Achieving a well-rounded distribution of core competencies within the organization

- Leaders should be moved to the most critical areas or places in which they can make the most impact (depending on the priorities at the time)

- Assuring all businesses have access to a sufficient supply of talent

Capital

- Optimizing capital allocation among businesses in order to maximize risk-adjusted returns

- Mergers and acquisitions and internal (projects) capital allocation

2. Organizational Design

Designing an organization involves creating a structure and related systems that maximize value for the firm. Leaders must consider the role of the head office (centralized or decentralized) as well as the types of reporting structures available to individuals and business units.

Organizational design is influenced by the following factors:

Decentralized vs. centralized head offices

- Assessing each business unit’s autonomy

- Choosing between top-down and bottom-up decision-making

- Business unit strategy is influenced by this

The organization’s reporting structure

- Establish a method for dividing large projects and initiatives into smaller ones

- Ensure that business units and business functions are integrated so that there is no overlap

- Separating responsibilities so the risk and return can be balanced

- A center of excellence should be developed

- Decide which authority should be delegated

- Establishing a governance structure

- Military/matrix-style reporting should be implemented.

3. Portfolio Management

It helps the firm decide where to “play” (i.e., which businesses to enter) by analyzing the complementarity between business units and their correlations.

Portfolio management is an integral part of corporate strategy:

- Decide whether to stay in or leave a business

- A firm’s vertical integration should be determined

- Diversifying and reducing correlations between business results to manage risk

- Securing strategic options by fertilizing new opportunities and if appropriate, heavily investing in them

- Maintaining a balanced portfolio in relation to market trends and monitoring the competitive landscape

4. Strategic Tradeoffs

Managing the tradeoff between risk and return is an important part of corporate strategy. Having a holistic view of all businesses is crucial for managing risk and generating returns at the desired levels.

Factors affecting strategic business tradeoffs

Risk management

- It is largely determined by the strategy that a firm pursues that determines its overall risk

- True product differentiation, for example, can lead either to market leadership or total ruin depending on how successful it is

- Copycat strategies are often adopted by companies by looking at what other risk-takers have done and modifiying it

- Having a thorough understanding of the strategies and risks that the firm faces is essential

- In some cases, it is necessary to differentiate (or lead on cost), while in others, incremental improvements may be sufficient.

- In order to manage this risk, business units need to have a certain degree of autonomy

Return on investment

- Riskier strategies may produce higher returns. If well executed, examples such as those above of product differentiation or cost leadership would provide the best returns over time.

- The portfolio should contain an appropriate number of options so you can swing for the fences without hitting the wall.

- Later, as the strategy develops, these options can become big bets.

Providing incentives

- Managers will seek a certain amount of risk and return based on incentive structures

- In order to achieve the desired level of return, risk management and return generation may need to be separated

- Similarly, it may help to disperse short-term risk and long-term return across multiple overlapping timelines, while managing multiple overlapping timelines.

The bottom line

Instead of focusing on competitive advantages, corporate strategy looks at how a firm manages its resources, risks, and returns.

Leadership decisions require consideration of a wide range of factors, such as resource allocation, organizational design, portfolio management, and trade-offs.

By optimizing all of the above factors, leaders can create portfolios of businesses that are worth more than their parts.