Buyers’ Bargaining Power: What is it?

It describes how customers/consumers can exert pressure on businesses to provide better service, lower prices, or improve the quality of their products as one force in Porter’s Five Forces Industry Analysis framework.

In analyzing the bargaining power of buyers, the seller (the company) takes the perspective of the buyer. As a result of using the companies’ products and services, customers/consumers have bargaining power.

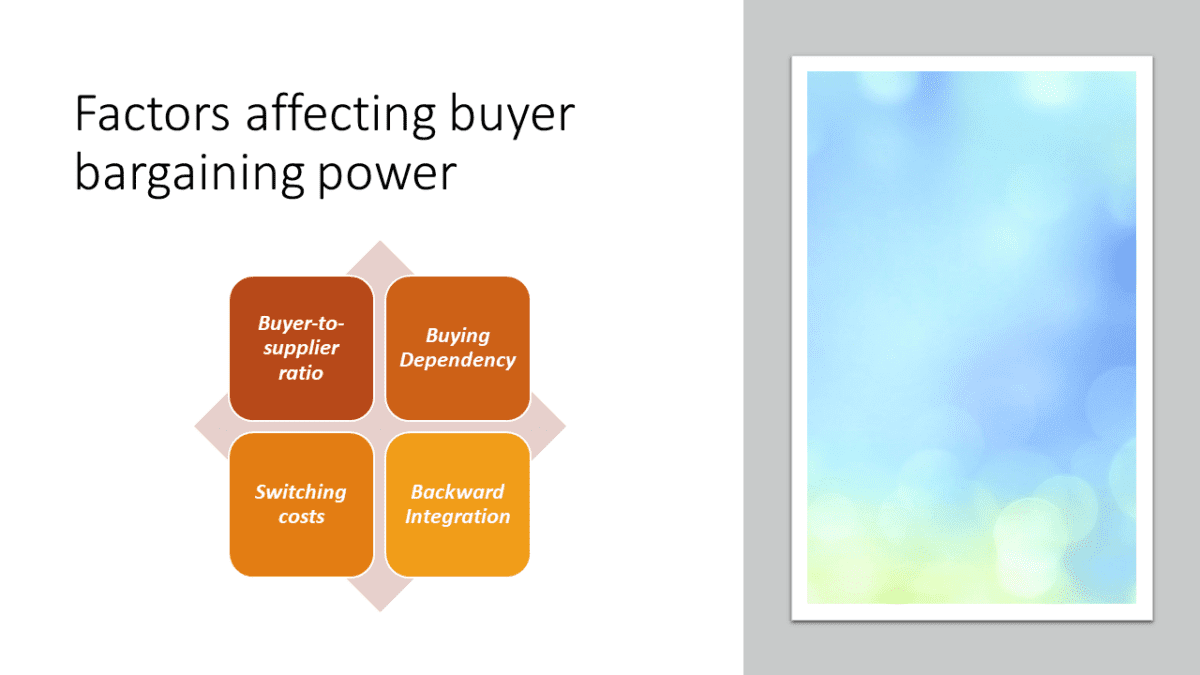

Factors affecting buyer bargaining power

When consumers (buyers) exert pressure on companies (suppliers), they can squeeze industry margins by reducing prices or increasing product quality.

The bargaining power of buyers can be determined by considering four major factors:

1. Buyer-to-supplier ratio

There will be more power in the buyer’s hands if there are fewer buyers than suppliers.

2. Buying from a particular supplier depends on the buyer

It is less likely that buyers will rely on one supplier if they can get similar products/services from another supplier. As a result, buyers would be in a stronger position.

3. Switching costs

The cost of switching suppliers is high when there aren’t many alternatives available. Due to this, there would be limited buyer power.

4. Backward Integration

A buyer with the ability to integrate or merge suppliers will have a stronger bargaining position.

When do buyers have high bargaining power?

- Suppliers outnumber buyers

- Buyers have low switching costs

- Backward integration is possible

- Bulk buyers (high volume)

- Other suppliers offer similar products/services

- Buyers purchase most products from sellers

- There are several substitutes

- A homogeneous product

Buyers’ bargaining power – when is it weak?

- Compared to suppliers, there are a lot more buyers

- Switching costs are high for buyers

- Ineffective backward integration

- The buyer cannot find similar products/services elsewhere

- Market substitutes are unavailable

- Differentiation is strong

Why Buyer Power Industry Analysis?

In addition to buyer bargaining power, there are also other forces that can contribute to external analysis of an industry, including new entrants and competition between existing competitors.

- Analysis of the industry’s threats and opportunities

- Analyze whether an industry can achieve above-average profits

- Identify the industry’s competitors

- Improve your strategic decision-making

Considering a buyer’s power is important when analyzing an industry from the outside, because it provides insight into the profitability potential. An industry with high buyer power is less profitable and less attractive. There is a possibility that both new entrants and existing firms will become more strategic in their decision making in order to improve their profitability.

An analysis of buyers’ power in Airline industry

Consider the following factors when determining whether airline buyers are in a high or low bargaining position:

1. Suppliers versus buyers ratio

Customers (buyers) outnumber suppliers (airlines) significantly. Customers can, however, choose an airline from a variety of options. Consequently, buyers have medium power.

2. Supplier dependence in buyer purchases

There are no differences in seat comfort between airlines, however some airlines specialize in better service compared to others.

The customer service provided by some airlines is awful, while the customer service provided by others is exceptional. Thus, airlines provide differentiated levels of service. There is a medium level of buyer power.

3. Switching costs

Low switching costs and high buyer power make it easy to switch between airlines.

4. Backward Integration

Backward integration is not possible for buyers. Due to this, buyers have little power.

The buyer power of the airline industry is overall high/medium based on the four factors that affect buyer power. As a result, the airline industry has a low profit potential.

An industry’s overall attractiveness is not determined solely by buyer power. It is important to take other factors (such as the threat of new entrants, competition between existing competitors, and supplier bargaining power) into consideration when determining an industry’s overall attractiveness.