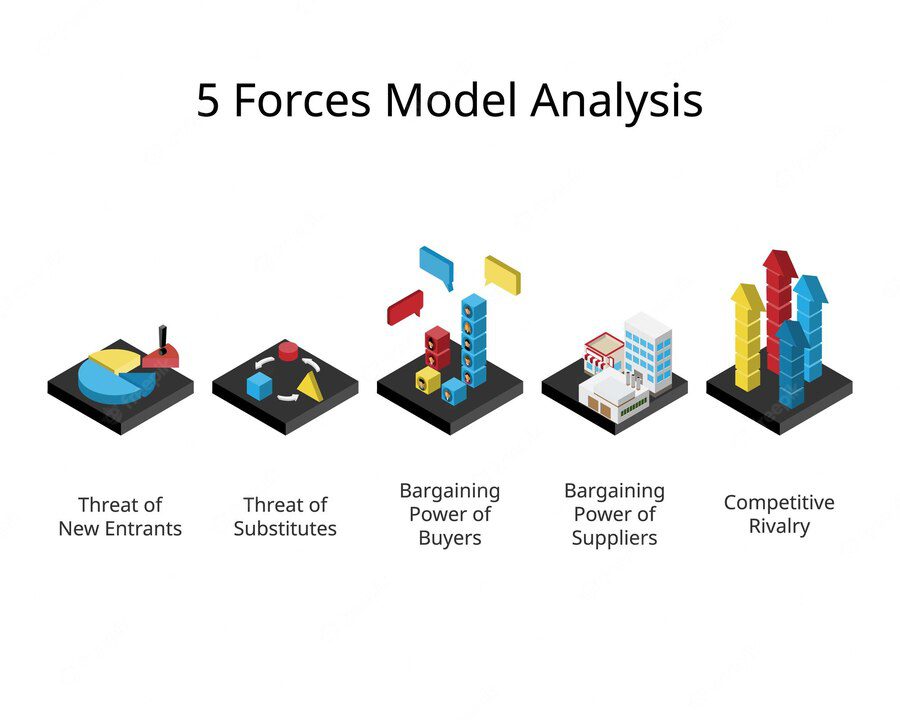

Competitive Forces Model: What is it?

An industry’s competitiveness can be analyzed using the Competitive Forces Model in strategic analysis.

Porter’s Five Forces Model, which includes five forces namely

- Intense rivalry

- Threat of potential new entrants

- Buying power

- Supplier power

- Threat of substitutes

are more commonly referred to as the Porter’s Five Forces Model.

We include complementary goods and/or services providers as a sixth force in our competitive forces model. To respond to the competition, a company can use the model to understand the risks in the industry it operates in.

Competitive Forces Model Template

Rivalry within an industry

Industry rivalry can be influenced by a variety of factors.

1. Rivalry concentration

Competitors are more intensely competitive when there are more of them

2. Homogeneous products

Competitiveness is likely to be higher in industries selling very similar products

3. Consumer switching costs

Customers are likely to switch to a competitor’s product if switching costs a lot

4. Production capacity that is too high

Companies find an industry more attractive to enter when excess production capacity is available in it

5. Loyalty to brands

When customers are not loyal to a brand, rivalry is high

6. Effects of networks

An additional user of a product increases its value. As more people use a product or service, its value increases.

Entrants who pose a threat

Several factors influence the threat of potential entrants, including:

- Customer loyalty to a brand

- Scale economies or cost advantages

- By achieving economies of scale through mass production, potential entrants are more likely to enter the market

- Costs of switching

- Effects of networks

- Overproduction

- Regulating authorities

- New entrants face higher barriers to entry in industries with strict government regulation

- Exit barriers

- It is less likely for companies to enter an industry when exiting it is expensive

- Equipment investment

- The amount of capital needed for specialist equipment is also taken into consideration by companies when entering a new sector

- A high level of fixed costs

- There are many fixed costs, such as the cost of specialist equipment, properties, land, and so on

- Skill specialization

- Potential entrants face a higher barrier to entry when entering an industry that requires specialized skills or techniques

An analysis of buyer bargaining power

For buyers to have a high bargaining power, they must:

- Companies are more affected by the decisions of large or concentrated buyers

- Large volumes are purchased by buyers

- Products, such as pricing and demand, are well known to buyers

Price-sensitive buyers are those who:

- The industry is highly competitive, so buyers have a greater choice of products and lower prices

- Substitutes are plentiful

- There are low switching costs, which makes buyers indifferent to whether a company’s products are better or worse than those of its competitors

- There is a high level of homogeneity in the product

Suppliers’ bargaining power

There is a high level of bargaining power among suppliers when:

- Concentrated or large suppliers

- There is a credible threat of forward integration in the industry from suppliers

- Small percentages of suppliers’ products are purchased by rivals

Prices are elastic for purchasers when:

- Alternative suppliers are few and far between

- Substitute inputs are few and far between

- Purchasers face high switching costs

A threat of substituting goods or services

Often, substitute goods/services pose a high threat to companies when:

- Customers have low switching costs

- Compared to current products, substitutes are more affordable

- A substitute has better performance characteristics or attributes

Complimentary Goods/Services Power

An industry can benefit from complementary products or services. In the event that complements do not provide value to consumers or have unattractive features that slow growth and limit profitability, the industry can suffer.

The decision-makers of a business should consider how they can integrate and include complementary providers in their strategies. Business benefits are likely to increase as a result of successful integration with complement providers.