Exit Strategies: What are they?

Businesses, investors, traders, and venture capitalists execute exit strategies to liquidate their positions in financial assets when certain criteria are met. Investors plan how to exit their investments, called an exit plan.

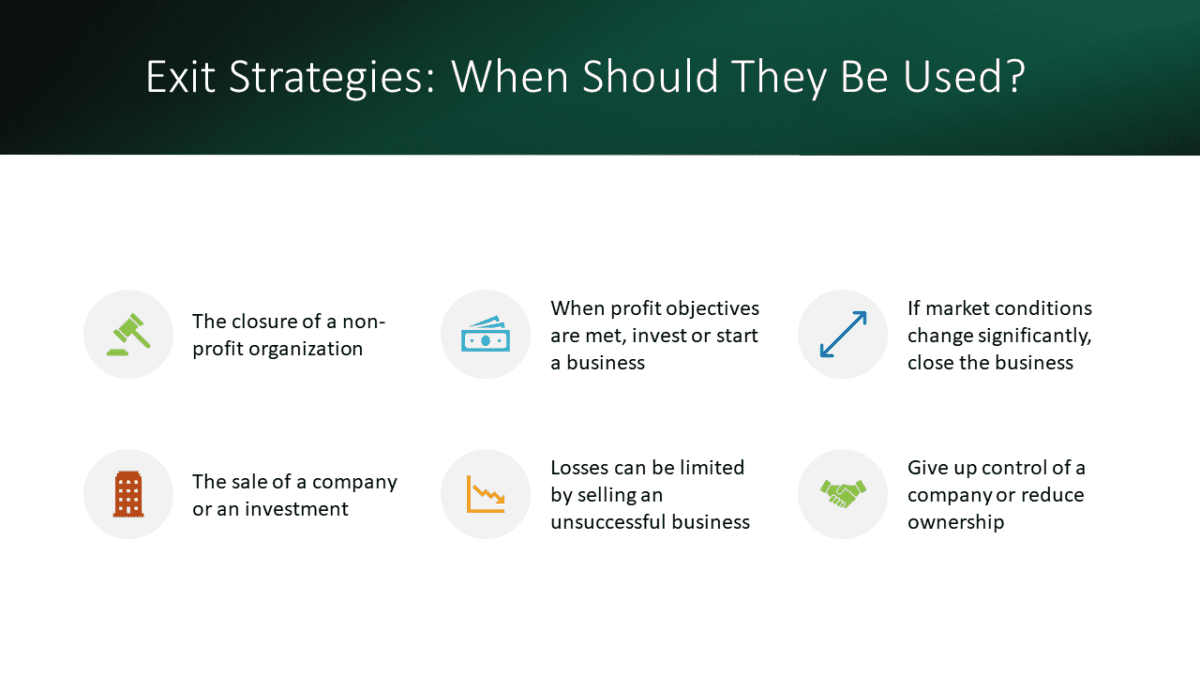

Exit Strategies: When Should They Be Used?

Exit plans can be used for the following purposes:

- The closure of a non-profit organization

- When profit objectives are met, invest or start a business

- If market conditions change significantly, close the business

- The sale of a company or an investment

- Losses can be limited by selling an unsuccessful business

- Give up control of a company or reduce ownership

Exit Plan Examples

Various types of investors or investors’ exit strategies include:

- Make sure you pay yourself bonuses before leaving your company. Nevertheless, make sure you are capable of meeting your obligations. There is no easier way to implement a business exit plan than this one.

- Retirees should sell their shares to existing partners upon retiring. The company will give you money when you sell your shares, and you will be allowed to leave the company after the sale.

- Take a market-driven approach to liquidating your assets. You can keep the remainder of the revenue after paying off your obligations.

- A public offering (IPO) is a way to go public.

- Acquire another business or merge with it.

- Obtain a full sale of the company.

- A family member can take over the business.

Start-up exit strategies

Entrepreneurs commonly use exit plans when selling their businesses. Business development decisions are strongly influenced by the choice of exit strategy that entrepreneurs develop before entering into business.

For example, if your company plans to go public (an IPO), certain accounting regulations must be followed. The majority of entrepreneurs are also not interested in working for a big company and prefer to start their own businesses. Entrepreneurs who have a well-defined exit plan are more likely to move on to their next big venture quickly.

Exit strategies include:

- IPO (initial public offering)

- Acquisitions of strategic assets

- Takeovers by management

Entrepreneurs choose their exit plans based on what role they want to play in the future of their companies. When an entrepreneur sells his or her founding company to a strategic acquirer, they will forfeit control of the company and all responsibilities associated with it.

Modelling and Valuation Exits

When building a DCF model, a terminal value is required. An exit multiple and a perpetual growth rate can be used to calculate the terminal value. A “multiple” of some measure, such as EBITDA, is used in the latter method, which is more popular among industry practitioners.

Exit Plans: Importance

The development of exit strategies may seem counterintuitive to business owners. Is it a good idea to sell your e-commerce business when it is making increasing revenues?

Even if you aren’t planning to sell your company right away, you should consider an exit plan. An example would be:

Crisis in the family or a personal health issue

A family crisis or personal health issue may affect your life. Your focus may be diverted from running the company effectively if you are dealing with these issues. In order to ensure smooth operation of the company, it would be helpful to have an exit plan.

Recession in the economy

Your company may not want to assume the impact of a recession if it has a significant impact on its operations.

Offers that surprise

You may face acquisition attempts from large players. You can still have an insightful conversation if you have thought about an exit strategy even if you don’t intend to sell the company immediately.

Clearly defined objectives

You will also have a clear objective if you have a well-defined exit plan. Strategic decisions are greatly influenced by an exit plan.