Asset Revenue Generating Efficiency (ARGE) is an index or measure of the extent to which an organizations asset are achieving their full revenue-earning potential and yield.

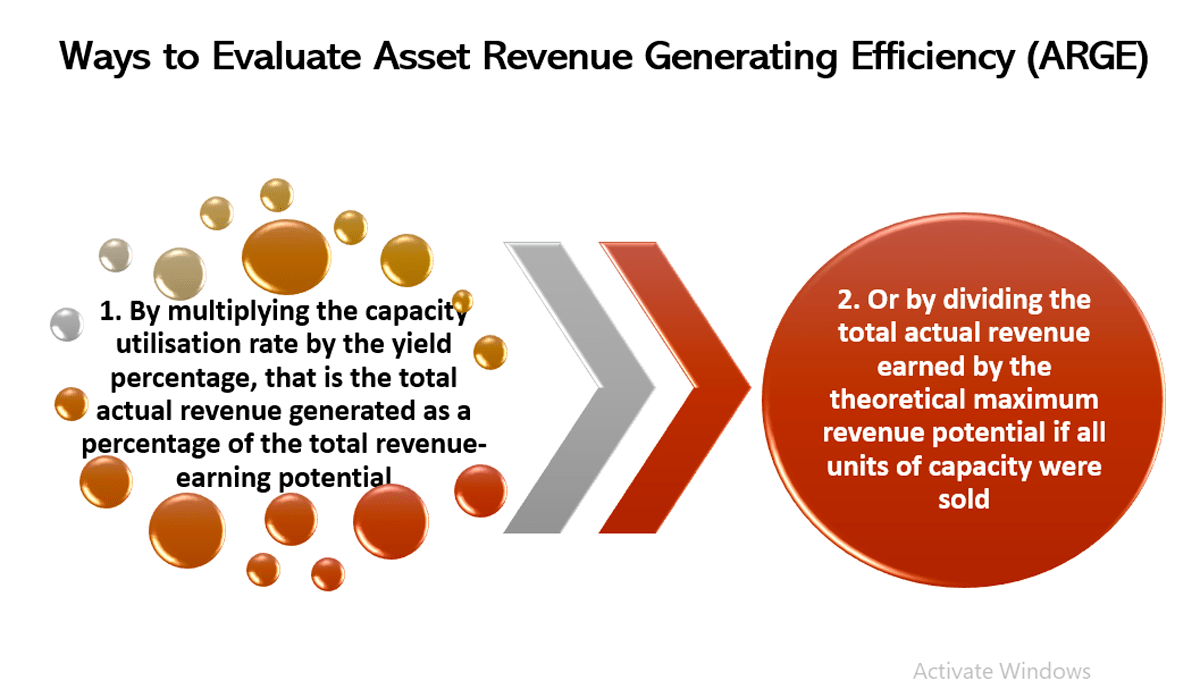

Ways to Evaluate Asset Revenue Generating Efficiency (ARGE)

Two ways to evaluate this:

- By multiplying the capacity utilization rate by the yield percentage, that is the total actual revenue generated as a percentage of the total revenue-earning potential

- Or by dividing the total actual revenue earned by the theoretical maximum revenue potential if all units of capacity were sold

Consequently, the decision to accept or reject business should be based on a realistic estimate of the probabilities of obtaining higher rated business, together with a recognition of potential damage to customer relations that might result from rejecting low-rated business.

Managers attempting to maximize revenues generated by each asset unit cannot assume that all costs will remain unchanged. Costs often vary. Therefore, meeting profitability goals requires a decision on how to allocate fixed costs, and the identification of the variable cost per sales unit. In this way a marketer creates flexibility in pricing based on variable costs with the aim of maximizing demand and return.

Maximizing ARGE in service organizations

Maximizing ARGE enables a service organization to improve productivity, to operate more cost effectively, to ensure that its assets or resources are achieving their full revenue-earning potential, to improve sales and profitability.

Furthermore, because ARGE maximization depends on customer knowledge, service organizations that pursue ARGE are likely to be better informed than competitors who do not.

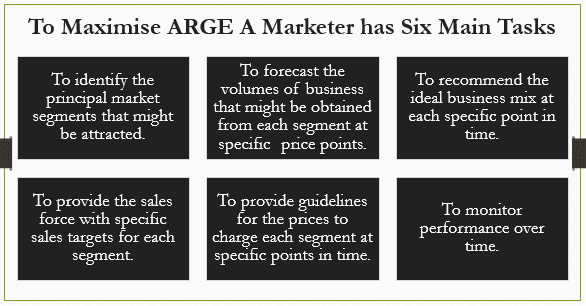

In order to help maximize ARGE a marketer has six main tasks:

- To identify the principal market segments that might be attracted.

- To forecast the volumes of business that might be obtained from each segment at specific price points.

- To recommend the ideal business mix at each specific point in time.

- To provide the sales force with specific sales targets for each segment.

- To provide guidelines for the prices to charge each segment at specific points in time.

- To monitor performance over time.

Yield Management defined

Managing yield is essentially concerned with obtaining the best possible yield or return from every available unit of capacity to be sold. And with ensuring that some return is obtained from perishable capacity units rather than nothing at all. It is a means by which the downside of the perishability characteristic of services can be effectively countered so that available capacity can be sold and utilized to its fullest potential and with the best possible return to the organization.

Concluding Notes

Establishing a pricing strategy for a service business is built on an estimate of costs to be recouped and desirable return, but must also take account of the cost, value and return to customers, as well as the nature and competitive positioning of the service itself.

This means that it is important to emphasize to students the role that both monetary and non-monetary costs play in formulating a competitively advantageous pricing strategy that is acceptable to (different segments of) customers and to the service organization itself. As well, we have highlighted the benefits to be gained from focusing attention on how the assets of a service organization can best be used in order to maximize yield and profitability.