Suppliers’ bargaining power: what is it?

It refers to the pressure suppliers can exert on companies by raising prices, lowering their quality, or reducing the availability of their products. The Bargaining Power of Suppliers is one of Porter’s Five Forces Industry Analysis Framework’s forces. It represents the mirror image of the bargaining power of buyers. Business strategy includes this framework.

Competitive environments and profit potential are influenced by the bargaining power of suppliers. A company’s buyer is its supplier, and its supplier is its supplier.

Supplier bargaining power helps determine the attractiveness of an industry by shaping the competitive landscape. In addition to competitive rivalry, buyer bargaining power, substitutes, and new competitors, there are other forces at play.

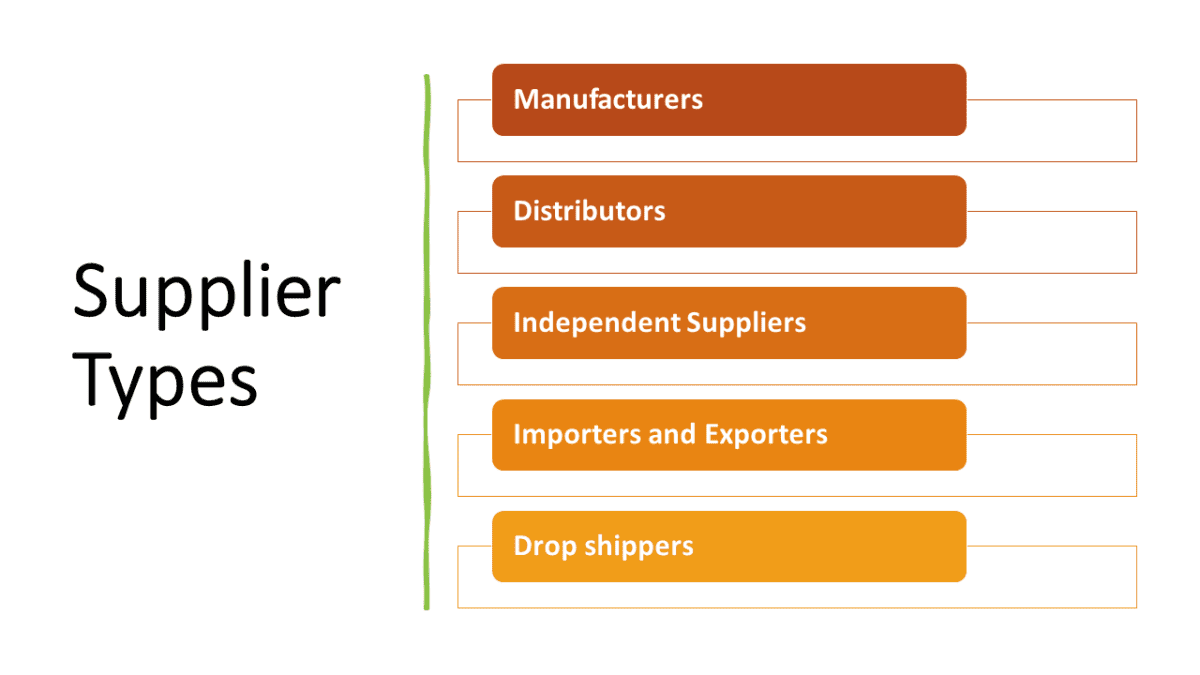

Supplier Types

Suppliers vary according to the industry. There are several types, including:

- Suppliers and manufacturers. Distribute, wholesale, and retail products

- Distributors and Wholesalers. Medium/high-volume purchases for local distributors or retailers

- Independent Suppliers. Retailers or agents may purchase unique products directly from you

- Importers and Exporters. Suppliers in one country purchase products from distributors in another

- Drop shippers. Companies that provide products to a variety of industries

Factors determining supplier bargaining power

The bargaining power of suppliers is determined by five major factors:

- Supplier-to-buyer ratio

- Suppliers’ sales are dependent on specific buyers

- Supplier switching costs

- Suppliers who are ready to accept immediate orders

- Suppliers may be able to integrate forward

When do suppliers have strong bargaining power?

- Buyers have high switching costs

- It is highly likely that forward integration will occur

- Compared to buyers, there are fewer suppliers

- There is little dependence on a specific buyer for the sale of a supplier

- Suppliers have low switching costs

- It is impossible to find a substitute

- Suppliers are a major source of sales for the buyer

Why is Suppliers’ Bargaining Power Weak?

- Buyers have low switching costs

- It is not likely that forward integration will occur

- Suppliers outnumber buyers by a large margin

- Suppliers are heavily dependent on certain buyers for their sales

- There is a high cost associated with switching suppliers

- It is possible to substitute

- Suppliers do not play an important role in the buyer’s sales

An analysis of supplier bargaining power was conducted for the purpose of

Buyers are not constrained by suppliers, so low supplier power increases profitability in an industry and makes it more attractive to buyers. Buyers rely more heavily on suppliers when supplier power is high, resulting in a less attractive industry and decreased profit potential.

Fast food suppliers’ bargaining power

McDonald’s bargaining power with suppliers can be determined by considering the following factors:

1. Supplier-to-buyer ratio

Suppliers outnumber buyers (companies) by a significant margin. The supplier has a low capacity, therefore.

2. Suppliers’ sales are dependent on specific buyers

It is likely that suppliers, especially those who have few customers (e.g., small or medium-sized firms) will concede to buyers’ demands. Suppliers, however, have more power over buyers if they have several customers.

In the absence of information about the number of buyers for these suppliers, a middle ground would be a reasonable approach. Hence, there is a medium level of supplier power.

3. Switching costs

Fast-food buyers have low switching costs because there are many suppliers. There is a low level of supplier power.

4. Forward Integration

The fast-food industry has a low level of forward integration.

There is little bargaining power among McDonald’s suppliers as a whole. As a result, McDonald’s does not have a problem with supplier power.

An industry’s overall attractiveness is not solely determined by suppliers’ bargaining power. In addition to buying power, rivalry between existing competitors, threat of new entrants, and substitute threats, other factors must be taken into account when determining an industry’s overall attractiveness.