WeChat managers develop several types of strategies based on the Strengths-Weaknesses-Opportunities-Threats (SWOT) Analysis / Matrix:

- SO (strengths-opportunities) Strategies

- WO (weaknesses-opportunities) Strategies

- ST (strengths-threats) Strategies

- WT (weaknesses-threats) Strategies

Segmentation in WeChat

A larger segment of the customer base that prefers personalized messaging.

WeChat’s Target Market

Almost all Internet users in China

Positioning on WeChat

Over a billion users have now become even closer with WeChat.

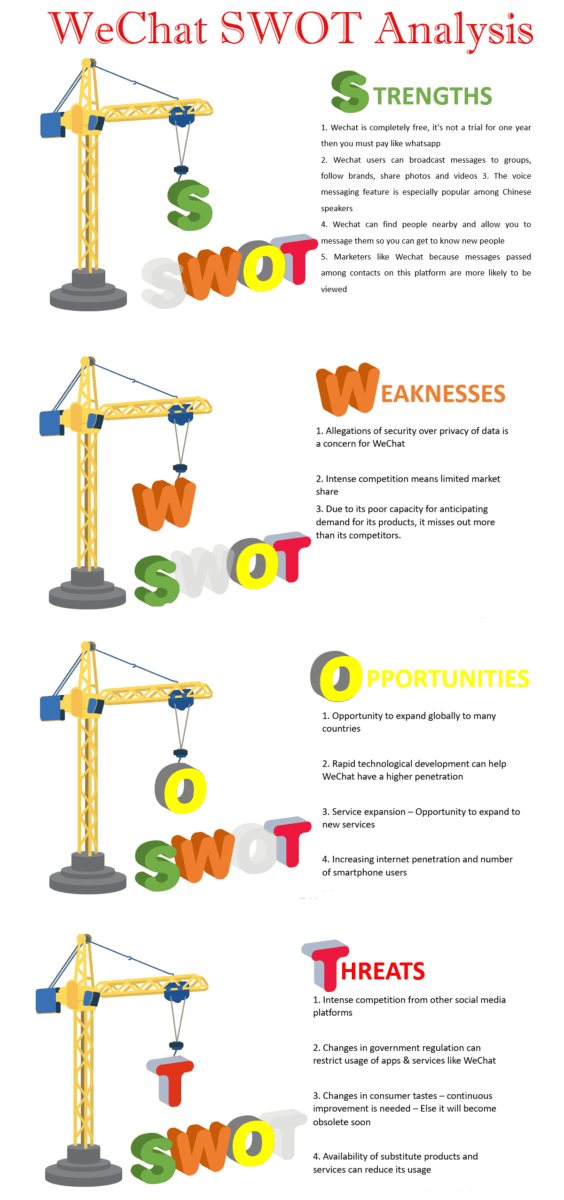

WeChat SWOT Matrix

WeChat managers use SWOT analysis to analyze their company’s situation regarding strategic planning. In the current business environment, it is a helpful technique to analyze the existing strengths, weaknesses, opportunities, & threats that WeChat is facing.

A major force in its industry, WeChat maintains its dominance through a careful SWOT analysis. SWOT analysis is an immensely interactive process and requires strong coordination between the marketing department, finance department, operations department, management information system, and strategic planning department.

An organization uses the SWOT Analysis framework to identify issues such as – strengths and weaknesses, – opportunities and threats. This results in a 22-matrix known as the SWOT Matrix.

Strengths of WeChat

WeChat is one of the world’s leading firms in its industry, so it has many strengths that enable it to thrive in the marketplace. In addition to protecting existing markets, these strengths help the company penetrate new ones. Here are a few reasons to use WeChat:

- WeChat has built a distribution network of proven reliability over the years that reaches most of its potential market.

- WeChat has been successful at breaking into new markets and maximizing their performance. This expansion aids the company in diversifying economic cycle risks in its markets and building new revenue streams.

- Its Go-To Market strategies are highly successful.

- Strong dealer community – In a culture of collaboration between distributors and dealers, the company enables dealers to market the company’s products as well as train their sales force to help their customers get the most from them.

- A good return on capital expenditure – Making good use of new revenue streams, WeChat has been relatively successful at executing new projects.

- Innovative products have been developed successfully in the past.

- Applied has established a successful track record of integrating complementary firms through mergers and acquisitions. It has in the past few years integrated several technology companies to enhance its supply chain and streamline its operations.

- WeChat’s strong brand portfolio has been built over several years. The SWOT analysis of WeChat is further evidence of this. Having the ability to expand into new product categories using a brand portfolio can be a huge advantage to an organization.

Weakness of WeChat

The areas of WeChat’s weakness are where the company can improve through SWOT analysis and at the same time keep a competitive advantage and strategic positioning. SWOT analysis reveals that a firm’s weaknesses are a key area where it can improve its performance.

- In the niche categories, the company has lost market share due to new entrants getting into the space and has had to deal with similar challenges. To counter these challenges internally, WeChat needs a direct channel of feedback to sales teams on the field.

- Due to its poor capacity for anticipating demand for its products, it misses out more than its competitors. In contrast to its competitors, WeChat takes a long time to forecast demand, resulting in higher inventory levels both in-house and in channels.

- Consequently, the organizational structure does not support expansion into adjacent products segments.

- As it was mentioned earlier in this text, WeChat has struggled to merge firms with different work cultures despite it being successful at integrating small businesses.

- The company sells too few product options, which makes it easy for competitors to enter the market.

- There was a lot of room for improvement in the product marketing. Despite being a big hit from a sales perspective, the product’s position and unique selling proposition has not been defined clearly, which can lead to the attack from its competitors in this segment.

- Compared to other companies in the industry, WeChat has a higher attrition rate, and it must spend much more than its competitors on training and development of its employees.

Opportunities for WeChat

- Buying WeChat products by the state and by federal government contractors is also a way for the government to go green.

- WeChat and other established players can greatly benefit from the new taxation policy and could possibly increase its profitability.

- Online channel customers – The company has invested vast sums of money into the online channel over the past few years. WeChat now has new sales channels due to this investment. With the use of big data analytics, the company can leverage this opportunity by knowing its customers better and serving their needs in the next few years.

- Environmental policies change – New opportunities come with new obligations, opening a level playing field to all the stakeholders in the industry. This is an opportunity for WeChat to gain market share in the new product category and to drive home its advantage in new technology.

- WeChat’s competitive advantage will be diluted by the market development and WeChat will become a larger competitor to the other major social networks.

- WeChat is offered the opportunity to practice differentiated pricing strategy in the new market with the new technology. By offering customers great service and other value propositions, the firm can retain its loyal customers and attract new ones.

- Consumer behaviors are changing and new opportunities for WeChat can arise. This should provide the organization with the opportunity to diversify into new product categories as well as develop new revenue streams.

- WeChat’s opportunity to enter emerging markets because of the adoption of new technology standards and government free trade agreements has created new markets for it.

WeChat Threats

- Since various laws and the changing nature of product standards continue to fluctuate in various markets, the company can face lawsuits in those markets.

- Some markets are also threatened by the growing strength of local distributors, who are paying higher margins than the competition.

- Especially in countries with low-income levels and economies in transition, WeChat’s product is also threatened by imitation of counterfeit and low-quality products.

- Compared to companies operating in a single country, the company is more exposed to currency fluctuations, especially considering the volatile political climate globally.

- Across certain global markets, a shortage of skilled workers constitutes a threat to WeChat’s steady profits growth.

- A rise in raw materials could put WeChat’s profitability at risk.

- The company has come up with a great number of products over the years, but those are often a direct response to the development by other companies. In addition, the supply of new products does not occur on a regular basis resulting in peaks and valleys within the sales figures over time.

- In the short to medium term, the profitability of the company may negatively impact any unlikely event during peak season during which demand for the highly profitable products are seasonal in nature.